Estate planning refers to a process through which one can plan to distribute or pass assets to the next generation. The process often is not very simple for high net worth individuals. In this simple to understand article I will try to touch some of the basics. There are some myths which will be discussed. Please do not consider this as a comprehensive guide to estate planning. I am planning to cover details of estate planning in a different post.

who is your nominee ?

You must know about the word ‘nominee’.

Nominee is someone whom you put in your bank account, insurance or in any other financial instrument as a beneficiary.

The importance of nominee comes into picture in case of investor’s death.

But in financial terms ‘Nominee’ is just a trustee.

Someone whom you trust to receive the money, insurance proceeds or any specific asset in case of your death.

But is the nominee entitled to enjoy the money / asset once he or she gets it ?

Let me clarify it with an example.

I have taken a term insurance in my life. And my wife is placed as a nominee in that.

If I die next week, who will get the money ?

Obviously my wife will receive the insurance proceeds from the insurance company after the claim gets settled.

But she may not entitled to 100% share of it.

Why ?

Because though I put her as the insurance nominee, I have not mentioned in any legal document that 100% of the insurance money will go to my wife.

As a hindu male, I have several Class – I legal heirs who are equally entitled to that money and hence my wife may not enjoy the money in totality.

In my case, My wife, My Mother & two minor kids are all Class – I heir as per hindu succession act.

And if my mother claims the insurance proceeds, my wife is legally bound to share the money with her.

In my case if I die without a will, the insurance amount may divide into 4 equal shares between my mom, my widowed wife & two minor kids.

So, if you want to make sure your wife gets the complete share of the insurance proceeds then you have to make a will ( The will is considered to be the legal last wish of the settlor ). Or else there is a different way to settle it.

In the next section we will talk about different ways of settlement post investor’s death.

| Important things to remember |

| #1. There was some amendment in Insurance Act, 2015 through which a special clause of beneficial nominee is added. So, definition of nominee & beneficial nominee is different after this amendment. As per this new amendment, if a policy holder adds a beneficial nominee in the insurance policy then insurance policy proceeds will be enjoyed by the beneficial nominee. But in case of your assets in bank, capital market or other assets the meaning of nominee is still just a ‘Trustee’. #2. I just put myself as an example to explain the situation. In reality the Class – I legal heirs are different for different person. If the investor died intestate (without a written will ) the default succession rules get applied. For example Class – I legal heirs for a hindu male is different than of a hindu female. For mohammedan / muslims, they are primarily governed by Muslim personal law. Buddhists, Sikhs are primarily governed by Hindu Succession Act. For Christians & Parsi in India we have Indian Succession Act, 1925. So, you need to understand the succession rules and plan accordingly. If you have any doubt take help of an expert on this. |

how to settle your assets ?

In the last section, I talked about nomination in details. I mentioned that nominee is generally a trustee.

Nominee is someone whom you trust to take charge of your money or assets in your absence due to death.

But nominee may not entitled to get your asset or money completely.

This is the reason, it is essential that you clearly distribute your assets or you give legal instructions to distribute your assets in case of your death.

If you are a married male and you want to make sure that your wife should be the primary beneficiary of your estate then you can settle that in following two ways.

#1 Will – A will is a legal document mentioning the last wish of the settlor.

#2 Using MWP Act, 1874 – Married Woman’s Property Act. ( Generally to settle insurance claims )

You can take help of a will to settle any asset and it includes insurance claims as well.

But often the execution of a will post death of the settlor is a long drawn process.

You need to prove the will in the court. And to get the probate of a will it takes long time. Also the process is not cost efficient.

The other option is taking help of Married Woman’s Property act to settle the insurance claims. Because often after sudden death of a policy holder, insurance money is the most important savior for the immediate family.

Married Woman’s Property act is quite historical, dated back to 1874 but this is still relevant in today’s world.

MWP act comes very handy to settle insurance claims in case of death.

If you buy an insurance policy under MWP Act, then your wife & kids are the sole beneficiary of the insurance policy.

No one in your family, or any other class I legal heir can claim the insurance money.

Married Women’s Property Act gives a comprehensive safe guard for wife & kids against any objection towards the insurance claim of the deceased.

In fact if the husband has lot of debt in the market, still the insurance money attached under MWP Act can not be liquidated to pay any debt.

MWP Act provides an insulation for the married woman & her kid(s).

So, you have a combination of two options.

Create a will and also use MWP as a provision wherever required.

The other option is to create a private family trust and manage the legacy better through the trust. But we will discuss about the trust later.

| Important things to remember |

| In the next section, #1 we will see the importance of insurance in Estate Planning. Whether we should consider buying insurance for estate planning or not ? And if we buy insurance – how much we should buy ? #2 MWP act is a comprehensive legal framework. If a husband put his wife as a nominee under MWP Act, and later want to update the nomination, then it is not possible. #3 If husband had lot of debts before death, then insurance claim after husband’s death can not be attached with any court of law if those are under MWP, Act. #4 The other noteworthy point is, if husband & wife are separated and the insurance nomination was taken under MWP Act, then the divorced wife will enjoy the insurance claim in case of husband’s death. |

how much life insurance do you need ?

In the last section, I talked about how to make sure the intended heir ( husband / wife ) gets the estate in case of investor’s death.

Today I am going to explain a different topic. I will be sharing a simple method to calculate – how much insurance you should take for your life.

Life insurance is important because it gives safe guard against sudden & untimely death of the bread earner of the family.

What should be the minimum sum insured ? A ball park estimation is 15X or 20X of your annual income.

But there is no standard rule which fits everyone.

Rather we should do a insurance need analysis to find out the insurable amount for estate planning.

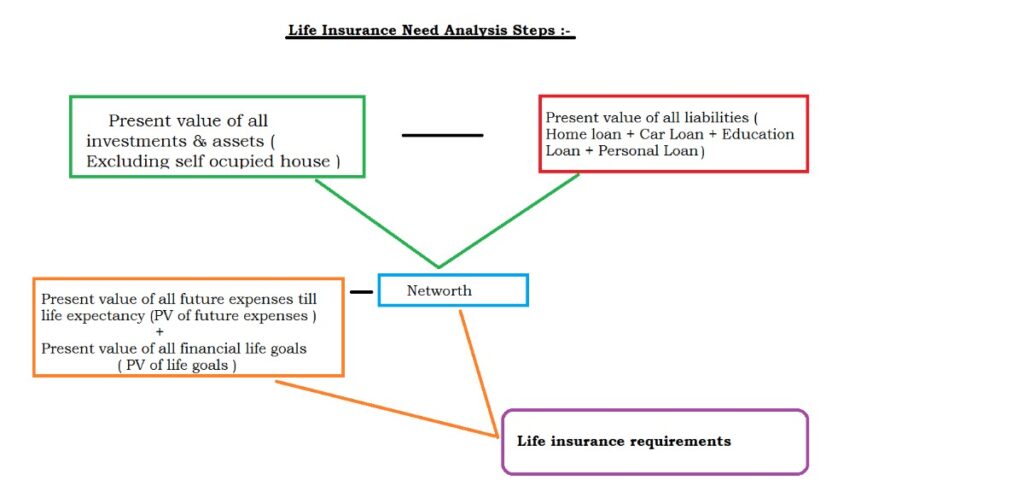

Quickly check the below flow chart to find the insurance need of your life.

If you are reading this in mobile, then zoom the below image to read it better.

Detailed explanation is provided below the chart.

Step 1: Identify following things in the beginning. Your family expenses per year, your specific life goals and also identify who are financially dependent on you.

Step 2: Identify what assets or present investments you have. Consider primarily financial assets. If you are staying in your own home, then do not consider the home when calculating your asset.

Step 3: Identify all your financial liabilities. For example – if you have a home loan, car loan, personal loan or an education loan running, please note it down.

Step 4: Now find the difference between present assets and current liabilities. Your net worth = (Present investment and asset value – Outstanding loan ).

Step 5: From step 4, you should get your present net worth. Calculating present net worth is essential to find out insurance requirements.

Step 6: Now project all your yearly expenses till life expectancy to current year. It is a summation of all PVs ( present values ) of future family expenses till death. I understand this step is very technical. But this is what you need to calculate.

Step 7: For all your goal based financial items, find their present monetary value. Example – Present value of kid’s higher education or kid’s marriage needs.

Step 8: You need to simply find differential value of following equation –

( Present value of all future family expenses [step 6] + Present monetary value of financial life goals [step 7] ) – Your present net worth [step 4]

This difference is broadly your life insurance requirements.

Please understand for simplicity I omitted many specific things like income status of your spouse, present asset of your spouse and details of taxation.

But broadly if you calculate your life insurance needs like the above and plan your estate accordingly, there should not be much to worry about.

In the next section I’ll focus on golden rules for your estate planning. These rules are simple yet most effective to manage your estate for next generation.

| Important things to remember |

| Life Insurance need analysis can be done in two methods. One is expense method & the other one is income method. I used expense method to calculate life insurance here. Expense method is more practical way of calculating life insurance need. |

the golden rules to transfer assets after death

None of us want to die from this beautiful world.

But death is inevitable. No one can plan his / her death.

As promised below are the golden rules for estate planning to follow.

These golden rules ensure that our family does not find it difficult if something happens to the bread earner.

Step #1 Take a piece of paper and clearly write location / places of your investments.

Mention in case of death which investments should be liquidated and after liquidation how your nominee should invest the proceeds in different investment vehicles. If you are not sure, take help of an expert planner.

Preserve this piece of paper with care. Share the information with your legal heirs / spouse / partner.

Step #2 Please think about your spouse / partner / legal heirs in a subjective manner.

Do you think, they are capable of understanding equity market ?

Do they able to liquidate investment position when the life goal is near or market is at peak ?

If you think they do not have these understanding, then please pay close attention to your asset allocation.

Opt for automated rebalanced portfolios or take help of an expert who can also act as a financial coach in case of investor’s sudden death.

Step #3 Educate your nominee or spouse about your life insurances. For example, I talk open & candid way with my wife on my life insurances.

She knows – how to claim the insurance in case of my death.

I shared a written instruction sheet with her. This will be handy if something happens to me.

Step #4 And finally, trust a person who has good personal financial knowledge.

Tell your spouse to contact that person in case of your death to settle things for the family.

Though I am financially well-versed, but I understand my wife may find it difficult if something happens to me.

Hence I told her, name of a trusted person who is a personal finance expert to help her if something happens to me in future.

Follow these 4 golden rules to make the estate settlement & re-investment process smooth in case of death.

All these processes are so easy & simple. But together they form a strong framework to pass on your estate to your legal heirs without much confusion & mental agony.

No one wants to talk about death but it is inevitable. There should be enough financial planning around it.

In the next section, I’ll highlight some special cases of succession act as an example. They are interesting to read.

estate rules those are important to remember

We learnt about nomination, legal heirs, will, MWP act, insurance need analysis, golden rules of estate management.

This section is the final one, on estate planning concepts.

Here we will discuss about few special rules on basics of Estate Planning.

Let’s find these special rules –

#1 For hindu female, in case she die intestate ( without a will ), her property will be distributed as mentioned in section 16 of Hindu Succession Act, 1956. As per this act, following are order of people who will claim the assets.

a) firstly, upon the sons and daughters (including the children of any pre-deceased son or daughter) and the husband;

(b) secondly, upon the heirs of the husband;

(c) thirdly, upon the mother and father;

(d) fourthly, upon the heirs of the father; and

(e) lastly, upon the heirs of the mother.

But the whole point here is, there is an exception to this rule. And the exception is – if the asset is inherited by the hindu female, from his father’s property and the female does not have any kids or the kids are dead, then dying intestate will distribute the said inherited property to the heirs of the father.

#2 As per hindu law, an unborn child has equal rights over the property if the unborn child is in gestation period when the settlor’s died intestate.

It essentially means, if a child is unborn but conceived and in mother’s womb, he / she has equal rights of the property if there is a property / asset settlement.

#3 If two people are married under special marriage act and their religions are not same, then their property can not be settled as per the personal law of that religion and it will be settled as per Indian Succession Act, 1925.

For example, if a hindu male marries a muslim female by special marriage act, then in future if the hindu male died intestate, his assets will be distributed as per Indian Succession Act & not Hindu Succession Act.

——————————–

There are many such unique rules & clauses for Muslims, Christians and other religions.

So, when doing estate planning we need to consider these specific rules / factors when creating an actionable & legal way of asset / estate transfer in case of death.

I hope we learnt some new things in estate planning through this article.

If you have any specific question on anything, then do not hesitate to reply back or add your comments in below section.